A simple guide to help you understand, prepare, and e-File Form 2290 for the tax year 2020-2021.

Businesses within the trucking industry understand the essence of HVUT compliance. A compliant business means sustainability and consistency.

With many businesses still recovering from a harsh 2020, not complying with the IRS would result in unwarranted penalties and interests.

So, be it a trucker or a trucking business, compliance is no longer a requirement – it’s a necessity. The rise in demand for compliance is directly proportionate to the ugly aftermath of noncompliance.

If you’re here, then you must also be desperately looking for a guide or some sort of help to navigate through the HVUT Form 2290 and its filing process.

So, let’s get to it.

What Is Form 2290?

Form 2290 is an IRS informational return used to figure and pay heavy vehicle tax. The IRS defines a heavy vehicle as any vehicle used for commercial or agricultural purposes weighing 55,000 pounds or more.

Tax professionals or the filer must report the vehicle information, such as the mileage utilized in a year, weight of the vehicle, vehicle identification number, and other such information.

The IRS uses the tax reports to interpret the highway utility and the tax received on highway infrastructure and development programs.

Origin Of Form 2290

Form 2290 dates back to 14th July 1986 when the FHWA (Federal Highway Administration) published a final rule implementing the requirements of the statute – Enforcement of Heavy Vehicle Use Tax in the Federal Registrar.

Form 2290 is since used to report the maximum weight and size of the vehicles utilizing the federal highways for commercial and non-commercial purposes.

What Is The Purpose Of Form 2290?

Let’s the discuss the purpose of HVUT Form 2290.

From The Taxpayer’s Perspective

For a taxpayer operating a trucking business, Form 2290 is used to report the vehicle information to communicate to the IRS about the purpose of use, the weight of the vehicle, mileage usage, period in which the vehicle was first used, taxable constituents, and other information.

This allows the taxpayer to figure and pay the tax per the HVUT tax norms, helping with HVUT compliance.

From The Perspective Of The IRS

All the information reported in the 2290 form is used to validate its credibility to ensure the accuracy of reports. The reports are further used to analyze and interpret the federal highway usage, damage caused by the heavy vehicles, investments in federal highway development programs, and concluding the pending projects and related decisions.

Additionally, the IRS maintains the database of the existing, new, and old trucking businesses and taxpayers in the industry to evaluate trends and compliance regulations.

Who Uses Form 2290?

Form 2290 must be used by the following individuals and entities.

- Truckers

- Trucking partnerships

- Trucking companies

- Owner-operators

- Agricultural transporters

- Heavy-duty transporters

- Internal trade transport entities

- Commercial goods transport entities

Please note that vehicles other than trucks that meet the HVUT criteria are also treated as heavy vehicles by the IRS and will be taxed accordingly. Taxpayers and entities alike must participate in the voluntary compliance program and contribute their share of taxes to help enhance the federal highway infrastructure of the country.

Form 2290 Taxable Gross Weight

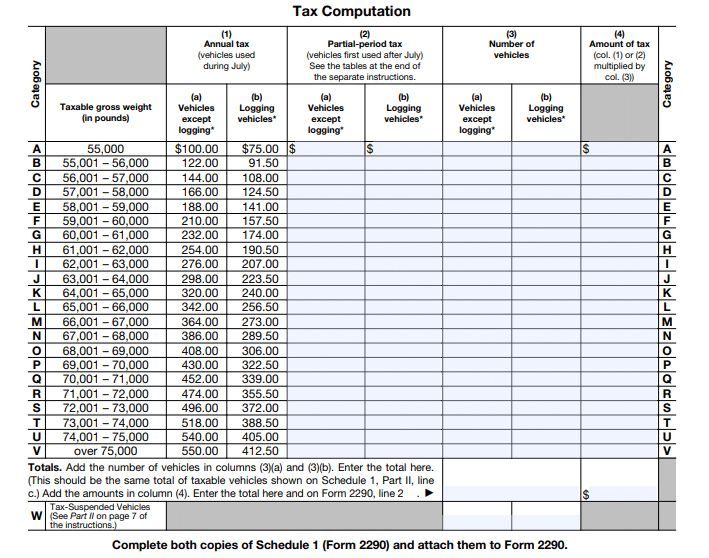

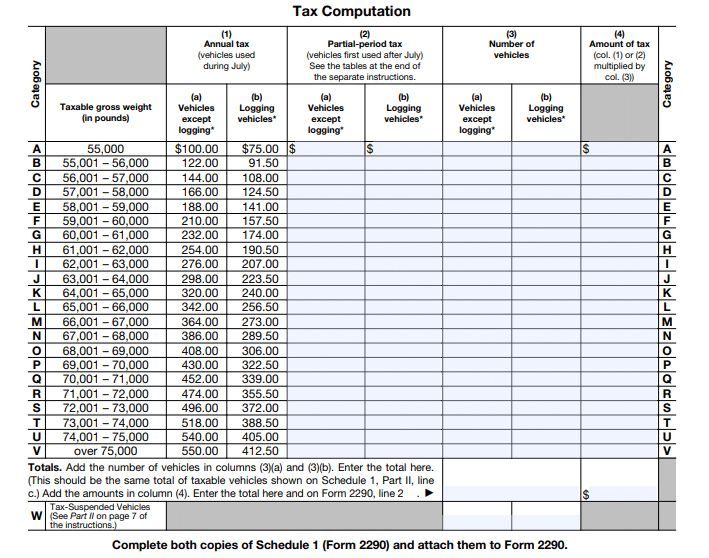

The IRS has set up a transparent tax computation process in order to tax a vehicle according to its taxable gross weight as follows.

Logging Vehicles

Vehicles that are used to transport forestry goods and trees to and fro from the harvest locations are called Logging Vehicles. Forestry goods and trees tend to be very heavy and logging vehicles are used for their immaculate strength and safety in transit.

A heavy load = additional pressure on the highway surface, which leads to eventual damage. Hence, Logging vehicles are taxed slightly higher than non-logging vehicles.

Exceptions For Form 2290

Certain individuals and entities are exempt from reporting with Form 2290, which are as follows.

- The Federal Government

- The District of Columbia

- A state or local government

- The American National Red Cross

- A nonprofit volunteer of the Fire Department, Ambulance Association, and Rescue Squad

- An Indian Tribal Government but only if the vehicle’s use involves the exercise of an essential tribal government function

- A mass transportation authority created under a statute that gives it certain powers normally exercised by the state

- Qualified blood collection vehicles used by qualified blood collection organizations

Form 2290 Boxes Explained

This is where the Actual 2290 Form starts for the filers.

You are required to fill all the fields that apply to you and provide the most accurate information. If you are unsure about the information you’re about to report, it is probably best to approach a tax professional or get support from our Tax Support Team here. This voluntary compliance approach will save you from being penalized for fraudulent or incorrect filings.

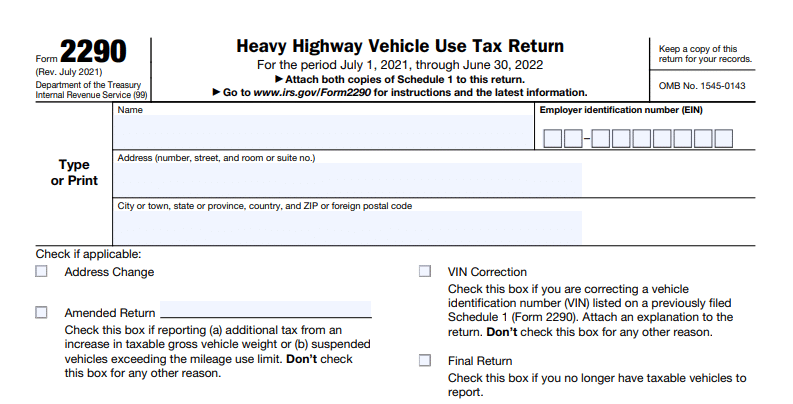

Name: This one can be a bit tricky. Always note that the IRS is not asking for your name. The IRS is asking the name of the business/entity on behalf of which you’re filing Form 2290. You can check if the name/TIN combination is correct by conducting a quick TIN check with the IRS. If the TIN/Name combination matches, then you can enter the name per the IRS records in this form.

EIN: Employer Identification Number is a special identification number assigned to employers and businesses. Validate your EIN before you report it in the return.

Address: Enter the operational address of your business per the IRS records. The IRS tracks your tax and compliance history by contacting the local tax authorities. When you enter the ZIP and address, the IRS will contact the authorities of the local area specified.

Check If Applicable: You can see that there are certain boxes, which you can select if they apply to you.

- If you are amending a previous 2290 return, then you can select the ‘Amended Return’ box.

- If you are filing this return to correct an incorrect VIN previously reported, then select the ‘VIN Correction’ box.

- If the operational address of your business has changed, then amend your business address by selecting the ‘Address Change’ box.

If this is your final 2290 filing; if you no longer own a taxable heavy vehicle or wound up your business, then you must select the ‘Final Return’ box.

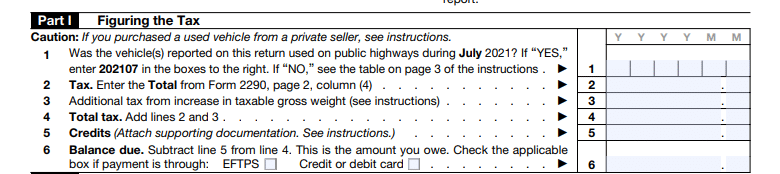

Part I Of HVUT Form 2290

- Enter the year in which the vehicle was first used by you or your workers for commercial purposes. For example, if the period in which you first used the vehicle was in July 2020, then enter 202007 in the first line of the right column.

- Calculate the total 2290 you need to pay for the current filing period and enter the final amount in the 2nd line of the right column.

- If your vehicle was subject to an additional tax liability for increased weight in the filing period, then the additional tax amount imposed on your vehicle must be entered in line 3 of the right column.

- Now calculate the sum of line 2 and 3 and enter the final tax amount in line 4 of the right column

- If you have overpaid your taxes, then you have a tax credit. Enter the tax credit amount in line 5 of the right column.

- Now, deduct the amount entered in line 5 from line 4, and enter the remainder amount here. This is the tax amount that you owe.

After this, you can select the method by which you plan to pay the tax you owe.

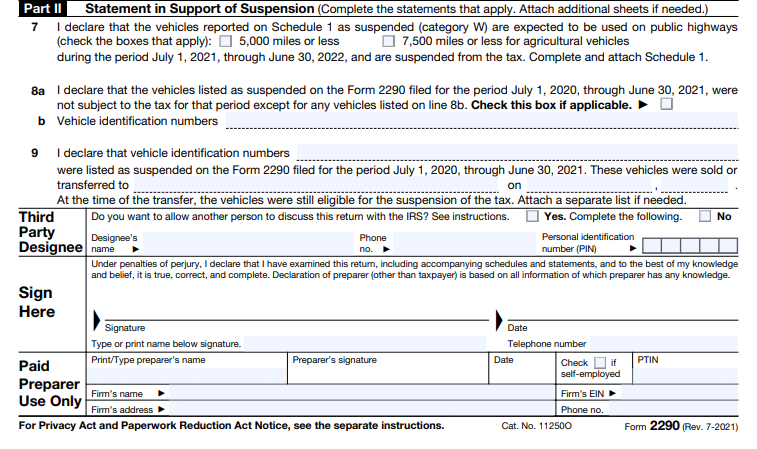

Part II Of Form 2290: Statement In Support Of Suspension

7) Declare whether the suspended vehicles that you have used on public highways are for agricultural or regular use.

8.A) Declare whether the suspended vehicles were subject to tax in the previous tax year. For 2020-2021, the previous filing year is 2019-2020. Check if your suspended vehicles were taxed in the 2019-2020 tax year.

8.B) Enter the vehicle identification numbers of the vehicles that were not subject to tax in the 2019-2020 tax year.

9) Declare the ownership transfer of suspended vehicles that were not subject to tax in 2019-2020 by entering the vehicle identification numbers, name(s) of the vehicle owner(s), and the date of ownership transfer.

Third-Party Designee: If you want another individual to be involved to discuss the details entered in the return with the IRS, then select the box in this section and furnish the Designee’s name, Personal Identification Number of the designee, and their phone number. If not, select ‘No’ and leave this section blank.

Sign Here: The taxpayer or the preparer has to make their declarations and furnish the signature to confirm that the information reported in the form is valid.

Paid Preparer Use Only: If you have hired a tax preparer, then he/she must provide the required information and provide their signature in this section.

Tax Computation: Form 2290

Logging Vehicles are vehicles that are used for transporting forestry goods and trees. Vehicles Except Logging are vehicles that are used for transporting products not related to forestry.

Heavy vehicles used for commercial transport are considered Vehicles Except Logging in the HVUT tax lingo.

Enter the number of vehicles in each of the columns as applicable to your business and calculate the tax.

For example, if you own 1 vehicle that weighs 55,000 pounds and another vehicle that weighs 65,000 pounds. Just type the number of vehicles (not the tax amount) in columns 3(a) and 3(b).

Now, calculate the tax by multiplying Column 1 or Column 2 with Column 3.

Enter the total amount in the last box of Column 4.

Schedule 1 Of Form 2290

There are 2 copies of Schedule 1 in every 2290 form. You must fill, complete and file both the forms to the IRS. However, only one of the copies will be stamped by the IRS and sent back to you as Proof Of Payment. You must document Schedule 1 for future use and reference.

Box-Wise Instructions For 2290 Schedule-1

- Enter your business name in the ‘Name’ box

- Enter the operational business address with the zip code

- Enter the EIN assigned to you or your business (must be in consensus with the IRS records)

- Enter the period in which the reportable vehicles were first used.

Enter the vehicle identification number and the category of each taxable vehicle in the Vehicles You Are Reporting box.

Summary Of Reported Vehicles

- Enter the total number of vehicles you’re reporting for the current filing period in Row A

- Enter the total number of vehicles in Category W on which the tax is suspended in Row B

- Now, deduct the total number of Category W vehicles from the total number of vehicles reported and enter the final number in Row C.

For example, if you have reported a total of 9 vehicles, and only 1 vehicle is suspended from the tax liability (Category-W Vehicles), then the total number to be entered on Row ‘C’ would be ‘8’.

How Do I Fill Out Form 2290?

You can type the information into an electronic version of the form and print it out to mail by paper. Alternatively, you can e-File with minimal effort. If you are using a smart e-Filing tool like EZ2290 for your HVUT filings, then you can complete the entire process of completing and eFiling in less than 15 minutes.

The most important thing here is to have all the required information by your side (regardless of the filing method you choose). It will fasten up your filing process and minimize errors in reporting.

How Do I File Form 2290?

You can file Form 2290 by paper or through electronic filing methods. While traditional paper filing takes more time to complete and process, the electronic filing comes with several automated advantages, which fasten up your e-Filing process.

Easily e-File Form 2290 Online With EZ2290

EZ2290 brings to you the smoothest 2290 e-filing experience. Receive the IRS-stamped Schedule-1 in just 4 easy steps. Further, our Smart Tax Calculator gives you an approximate estimate of the total tax you owe.

- Create Your Free Account

Sign up to create your free EZ2290 account

- Enter Business & Vehicle Information

Enter the required business and vehicle information to calculate tax and report.

- Submit To The IRS

Submit your returns to the IRS through our secure e-filing platform.

- Get IRS Stamped Schedule-1 Instantly

Receive the IRS Stamped Schedule-1 within minutes of successful submission

You do not have to pay us anything until you choose to submit your forms to the IRS.

Due Dates For Filing Form 2290

Due date for filing Form 2290 for the tax year 2021-2022.

For Tax Year 2020-2021

Truckers and trucking businesses must be filed the IRS Form 2290 for Heavy Vehicle Use Taxes (HVUT) every year by August 31st for the current tax period for heavy highway vehicles begin on July 1, 2021, and ends on June 30, 2022.

For Previous Tax Years

Use the following table to determine the due date for vehicles purchased and used in the current and previous filing periods.

| If The Vehicle Is First Used During This Period | File Form 2290 And Make Your Payment By | Enter This Date On Form 2290, Line 1** |

| July | August 31 | YYYY07 |

| August | September 30 | YYYY08 |

| September | October 31 | YYYY09 |

| October | November 30 | YYYY10 |

| November | December 31 | YYYY11 |

| December | January 31 | YYYY12 |

| January | Last day of February | YYYY01 |

| February | March 31 | YYYY02 |

| March | April 30 | YYYY03 |

| April | May 31 | YYYY04 |

| May | June 30 | YYYY05 |

| June | July 31 | YYYY06 |

IRS Form 2290 Schedule 1

Schedule-1 of Form 2290 is proof of payment of the HVUT tax. This document is issued by the IRS with the official acceptance stamp. Schedule-1 must be documented and can be used as evidence for payment proof when amending returns. Additionally, Schedule-1 also comes in handy when you want to request suspension of tax for a vehicle.

What Is Form 2290 Amendment?

It is important to note that Form 2290 Amendment is not a separate form. You can report the amendments you want to make through Form 2290 by selecting the “Amended Returns” box. You can only file an amendment for previous returns.

You can file an amendment for your previous returns in the following scenarios.

- Increase In The Taxable Gross Weight Of The Vehicle

If the weight of your vehicle increases during a tax year, you must file an amendment to communicate to the IRS about the change in the vehicle weight. Increased vehicle weight = Increased tax liability.

- Suspended Vehicles Exceeding The Mileage Use Limit

Regular heavy vehicles are limited to use 5000 miles (7500 miles for agricultural vehicles) in a tax year. If the vehicle exceeds this mileage use limit, then the same must be communicated to the IRS through 2290 amendment.

- VIN Correction

If you have reported an incorrect VIN in the previous returns, then the 2290 amendment must be used to correct the VIN. An incorrect VIN may increase the risk of file rejections citing noncompliance.

In Conclusion

The IRS is strict about HVUT compliance since HVUT is one of most important sources of generating revenue for the state. Complying with these regulations would allow the businesses to maintain tax transparency and enjoy the perks of being a compliant business, while non-compliant businesses will have to look forward to a taxing future.

While the traditional paper filing method is time taking and requires a professional by your side, smart e-Filing platforms like EZ2290 are enabling businesses to comply easily and e-File for a large number of vehicles in a few minutes.

Convenience is the only way forward for trucking businesses with large fleets that want to comply.

Related Ez2290 Blogs:

What Is Form 2290? Are You Required To File It?

IRS Form 2290 Instructions For The 2021-2022 Tax Year

Vehicle Identification Number (VIN) – Here’s Everything You Need To Know

IRS Form 2290 Due Date For The 2021-2022 Tax Year

Everything You Need To Know About IRS Form 2290 Amendment

Complete HVUT Compliance For Your Trucking Business With EZ2290