eFile 2290 Amendments Online

IRS Form 2290 Amendments Online Filing Easy With EZ2290.

E-File 2290 NowIRS Form 2290 Amendments Online Filing Easy With EZ2290.

E-File 2290 Now

Businesses, owner-operators, truckers, and other entities that eFile Form 2290 may amend the information previously reported by filing Form 2290 Amendment.

From a general perspective, an amendment is nothing but a “correction” of the information previously reported to the IRS through Form 2290.

Entities and individuals alike must file 2290 Amendment in a variety of scenarios, where they communicate to the IRS about any changes to the vehicle or misreported information.

Start amending your 2290 eFiles with EZ2290 for the 2025-2026 tax year.

File A 2290 Amendment Now

Businesses, owner-operators, truckers, and other entities that eFile Form 2290 may amend the information previously reported by filing Form 2290 Amendment.

If the taxable gross weight of your highway motor vehicle increases during any given period, then you must communicate such information to the IRS. File 2290 Amendment Online for the same and update your HVUT tax records.

When the taxable gross weight of the vehicle increases, the vehicle falls into a new category. In such a case, you will be imposed with an additional tax.

You must report the additional gross weight for the remainder of the period on Form 2290 and specify the month in which the taxable gross weight was increased.

For example, if the taxable gross weight increased in July 2025, then you have to report it by August 31, 2025.

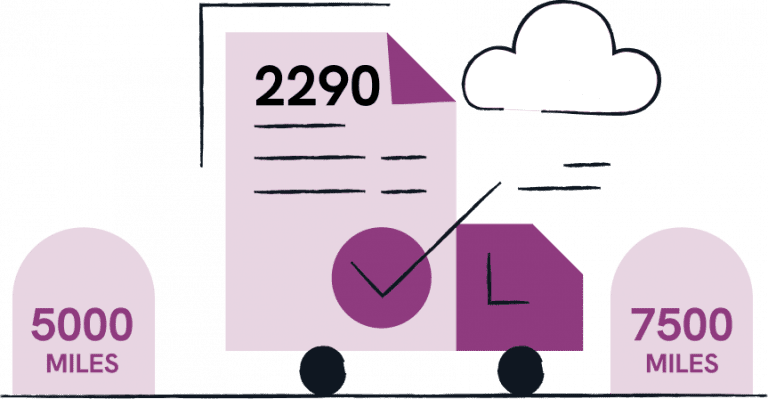

File A 2290 Amendment NowEntities and individuals must file an amendment if the suspended vehicle exceeds the mileage limit. When reporting such information on Form 2290, do keep a few things in mind. The Mileage Use Limit for non-agricultural vehicles is 5000 miles or less and 7500 miles or less for agricultural vehicles. The Mileage Use Limit applies to the total mileage for which the vehicle was used on the road The Mileage Use Limit will not change even if the vehicle has several owners You must report the month in which the mileage limit exceeded in Form 2290. Form 2290 Amendment must be filed by the last date of the month following the month in which the mileage has increased. For example, if the vehicle exceeded the mileage use limit in July 2025, then you have to report it by August 31, 2025.

File A 2290 Amendment Now

This is one of the most common scenarios where trucking entities file for an amendment

When you enter an incorrect Vehicle Identification Number in Form 2290 , the IRS will reject the filing or may issue a notice and/or penalty for filing inaccurate information.

You can easily correct this mistake by filing a 2290 Amendment. Enter the right Vehicle Identification Number in the amendment and submit the form to the IRS.

However, there are certain restrictions to exercising this option:

If you have never filed an amendment before or if you’re a seasoned tax professional who is e-filing on behalf of your clients, then we’re here to make things easy for you.

Create your EZ2290 account hereto get started. No credit card details are required. Sign-up is absolutely free.

If you’re a member, log in to your EZ2290 account.

If you find yourself agreeing to any of the following scenarios, you need to eFile Form 2290 Amendment:

your vehicle has been suspended in the prior year, then you must not eFile Form 2290 Amendment for such a vehicle.

When you eFile 2290 Amendments with EZ2290, the IRS will send an electronic version of the Schedule-1 for the amended return. You can save the PDF on your personal computer.

Switch to EZ2290 to securely eFile IRS Form 2290 Amendments. With Penalty Prevention Programs, 256-Bit Security Encryption, live tax support, and many other useful features, EZ2290 is the best solution for convenient HVUT eFiles.

Yes. All you have to do is register with us and create your account.

Select the 2290 Amendment service from your EZ2290 dashboard, and select ‘Amendment’ in the form.

Provide your business and vehicle information in the returns like you usually do and we will transmit your files to the IRS within minutes.

You will also receive a PDF of the Stamped Schedule 1 directly from the IRS – confirming your submissions.