When To File a Form 2290 by Due Date.

Mary purchased a truck and needs to get it registered by the due date. In order to do this, she needs to file a Form 2290. The problem is, Mary isn’t sure exactly when she is supposed to file a Form 2290.

A Form 2290 must be filed on the vehicle by the last day of the month after it was first used (i.e. if first month used is February, then you will need to file the 2290 by March 31st). The first month of use is the month the vehicle was first driven on a road or highway from the place it was purchased, according to the IRS. The current tax year runs July 1st 2016 through June 30th 2017.

You will need to file a 2290 for this tax period on any vehicles you own that have a taxable gross weight of 55,000 pounds or more.

Payment can be submitted in 3 ways.

- ACH-Direct Bank Account Draft: Where the money is taken right out of your bank account. Depending on your bank, the money may come out of your account the same day or the next business day after the IRS accepts the return. We help make sure you have the right routing number when you pay via ACH.

- Check/Money Order: Where you can mail in the form of payment to the IRS with the payment voucher. Make your check or money order payable to “United States Treasury.” Write your name, address, EIN, “Form 2290,” and the date (as entered in Box3) on your payment.

- EFTPS: Where you enroll on the IRS website www.EFTPS.gov and create an account. You can pay your taxes there on the site through your financial institution. If the pay date falls on a Saturday, Sunday or Holiday pay on the next business day.

New Truck.

You need to file a Form 2290 anytime you purchase or lease a new truck. In order for you to get your registration and license plate, you need to file a Form 2290 or else you won’t be able to drive your truck or make any money. You don’t want that!! Remember the tax period runs from July 1st to June 30th. [was-this-helpful]

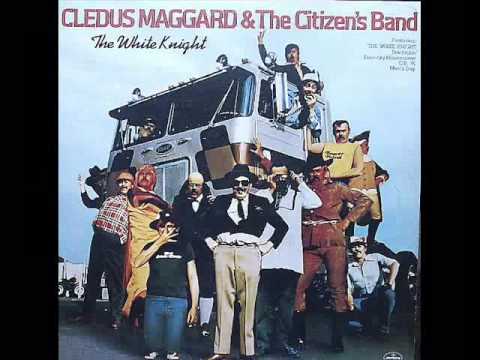

Just in case you missed it – CB Lingo Refresher