The Best IRS Approved 2290 E-File Provider – EZ2290

Need to submit IRS Form 2290 for 2025? EZ2290 helps you handle it. We have over a decade of experience in file 2290 electronically as an IRS-approved 2290 e-File provider.

E-File 2290 NowNeed to submit IRS Form 2290 for 2025? EZ2290 helps you handle it. We have over a decade of experience in file 2290 electronically as an IRS-approved 2290 e-File provider.

E-File 2290 Now

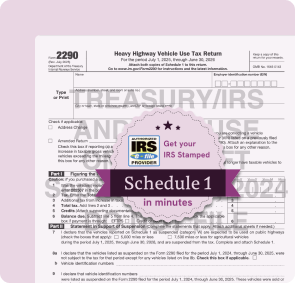

With EZ2290, your Best 2290 E-File providerand approved by IRS you can easily e-file your 2290 directly to the IRS online. Plus, you’ll receive your IRS-stamped Schedule 1 copy as proof straight to your registered email within minutes of IRS approval.

Choosing IRS Authorized E-File Providers offers several key advantages. It ensures compliance with IRS regulations and standards, minimizing the risk of errors or penalties. The IRS puts these providers through a strict review process to ensure they are trustworthy and capable of handling tax filings.

These providers send your tax information using encryption to prevent unauthorized access. By selecting a trusted IRS-approved e-file provider, you make Electronic HVUT Tax filing easier and ensure your Form 2290 is done with precision and care.

Gain Confidence in Your Heavy Highway Vehicle Use Tax 2290 E-Filing. No need to book appointments, visit the IRS office, or wait in long lines anymore. With EZ2290, your IRS-approved 2290 E-File service provider, you can easily e-file your 2290 directly to the IRS online. Plus, you’ll receive your IRS-stamped Schedule 1 copy as proof straight to your registered email within minutes of IRS approval.

When selecting an e-file provider, it’s crucial to consider various factors. Here are key considerations:

Ez2290 fulfills these requirements. With secure transmission to the IRS, comprehensive customer support, simplified filing process, and time-efficient services, we ensure a seamless and error-free experience.

Our internal error checking system further enhances accuracy, and our step-by-step e-filing guide provides guidance throughout the process. Trust Ez2290 to handle your filing needs effortlessly while offering top-notch features and support for an exceptional user experience.

You can verify the authorization status of an e-file provider on the IRS website 2290 e-File Providers list or look for the IRS authorization logo on their platform.

Authorized e-file service providers are businesses or organizations officially sanctioned by the IRS to electronically transmit tax returns for individuals and businesses. These providers must meet IRS standards and regulations, including passing suitability tests. Upon approval, the IRS assigns them an Electronic Filing Identification Number (EFIN) as an official authorization ID, ensuring compliance and trustworthiness in handling tax filings.

Using an authorized provider ensures that your filings meet IRS standards, reducing the risk of errors or rejection. Additionally, they often offer user-friendly platforms and timely support.

The turnaround time for receiving your IRS-stamped 2290 Schedule 1 copy can vary depending on the provider and IRS processing times. E-File provider, such as EZ2290, offers to deliver the stamped copy within minutes of IRS approval.

Our EZ2290, #1 Platform for 2290 online filing includes 4 different options for submitting 2290 payments to the IRS for your HVUT.

You can get your IRS-stamped Schedule 1 really easily, without having to wait for days. All you have to do is use EZ2290 to submit your HVUT returns to the IRS.

Once the IRS receives your e-returns successfully, you will receive a PDF of the Stamped Schedule 1. This is just as valid as the physical copy of the Schedule 1.