IRS Form 2290 Instructions

Unlock the Secrets of Form 2290 with our Step-by-Step Instructions and Proven Tips

Unlock the Secrets of Form 2290 with our Step-by-Step Instructions and Proven Tips

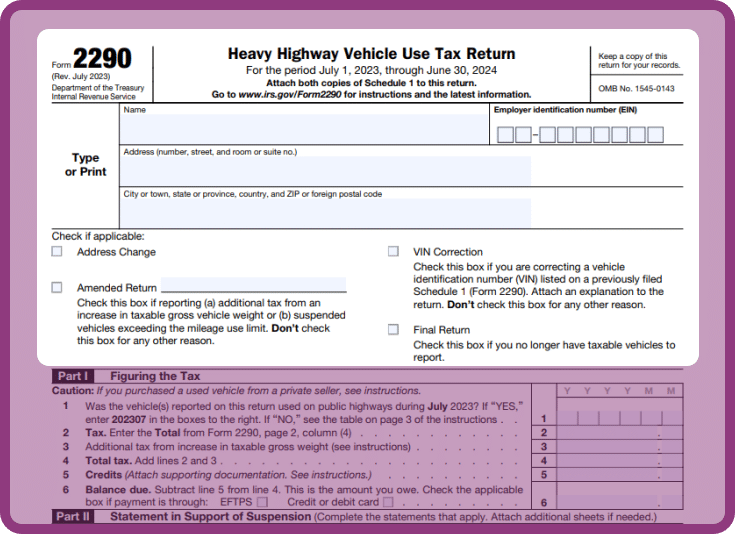

The Business Details

The first section of Form 2290 requires you to provide essential information about your business. This includes your business name, Employer Identification Number (EIN), and address. Make sure to accurately enter the details as requested.

second section of Form 2290 deals with amendments or filing a final return. This section offers several options:

It’s important to remember that if you are not making amendments or filing a final return, you can proceed to the next section of the form. Ensure the information you provide is accurate and reflective of your specific circumstances. Always double-check your entries before submitting the form to avoid any discrepancies.

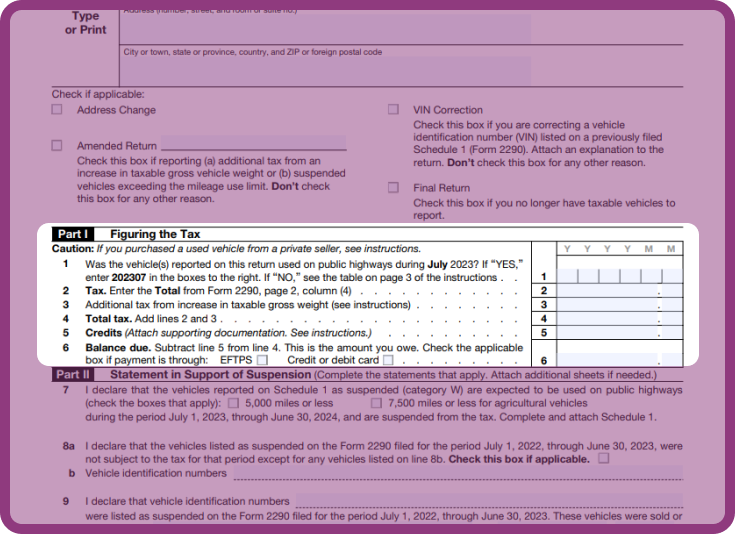

The Business Details

The first section of Form 2290 requires you to provide essential information about your business. This includes your business name, Employer Identification Number (EIN), and address. Make sure to accurately enter the details as requested.

second section of Form 2290 deals with amendments or filing a final return. This section offers several options:

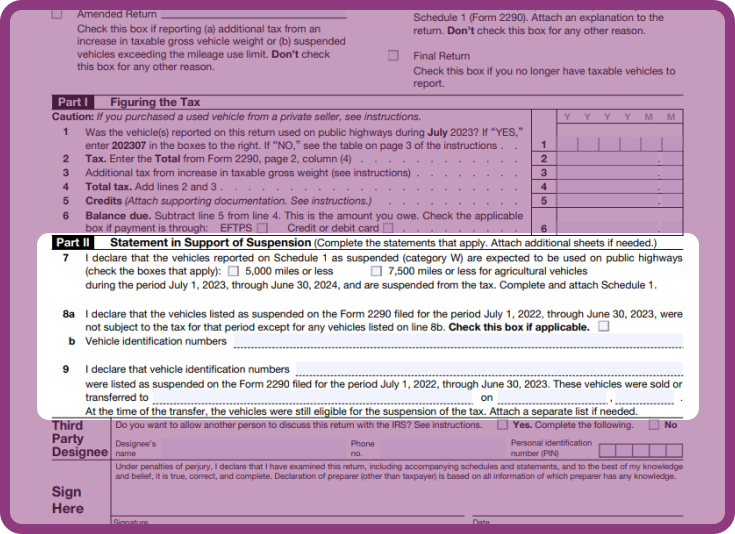

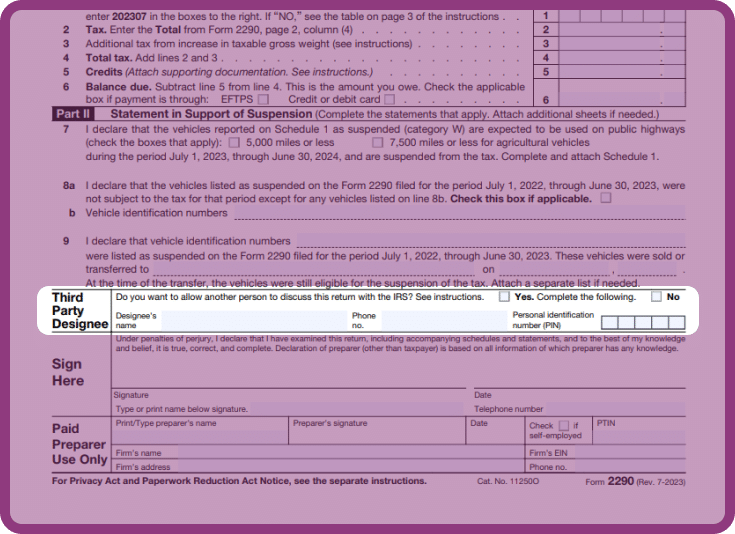

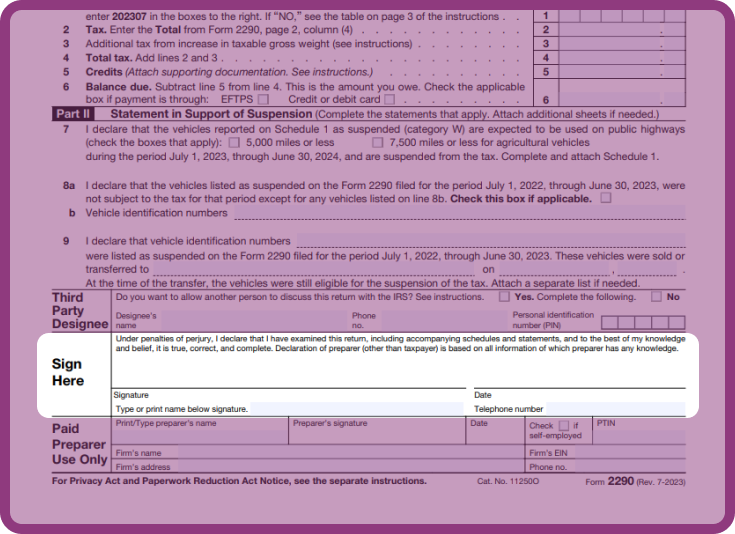

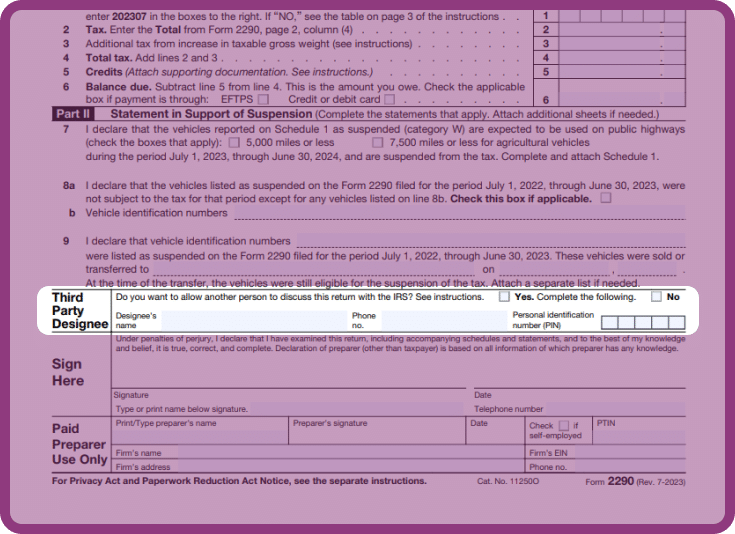

Authorize someone to discuss your Form 2290 with the IRS by following these steps:

Check “Yes” to grant permission for a third party to discuss your Form 2290.

Provide the following information for the designated person:

By designating a third party, you allow them to communicate and discuss your Form 2290 with the IRS. This is helpful when seeking assistance or representation from a tax professional or representative.

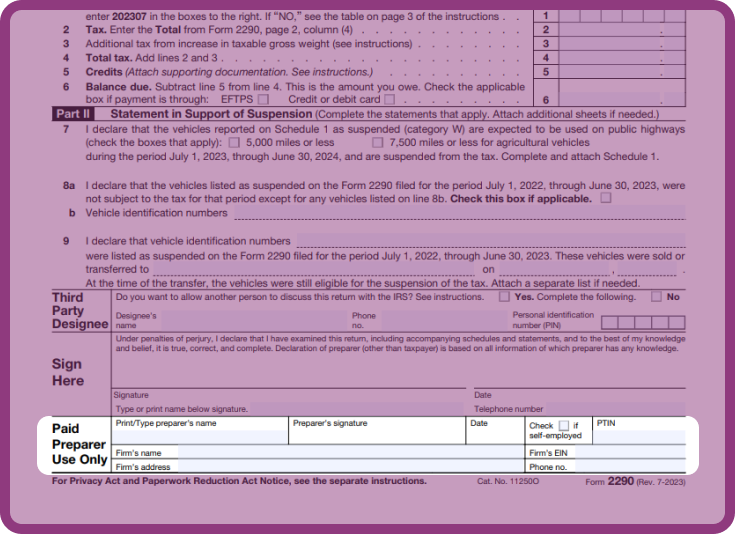

Ensure a smooth filing process by following these steps to sign your Form 2290:

Unsigned forms will be returned and not considered filed. Sign your Form 2290 before mailing it to the IRS.

If you have engaged a paid preparer to file your Form 2290 on your behalf, they are responsible for completing this section with the following details:

This section is for paid preparers only. If required, provide accurate details for effective communication with the IRS.

The calculation of HVUT (Heavy Vehicle Use Tax) is based on the taxable gross weight category and the number of taxable vehicles. Here’s how the tax computation works:

Ensure accurate calculations and reporting of the taxable vehicles and their associated taxes to comply with HVUT requirements.

Please note that the information provided is for general understanding and may vary based on specific circumstances. It is essential to consult the latest IRS guidelines and regulations for accurate tax computation and payment.

Form 2290 includes two copies of Schedule 1. Complete both copies and file them with the IRS. Here’s what you need to know:

Check “Yes” to grant permission for a third party to discuss your Form 2290.

Provide the following information for the designated person:

Ensure both copies of Schedule 1 are completed accurately and filed with the IRS. Retain the stamped Schedule 1 as proof of payment.

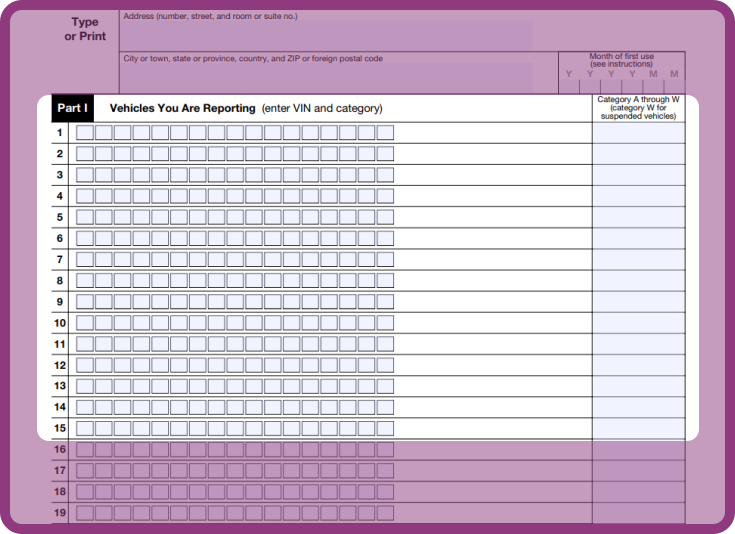

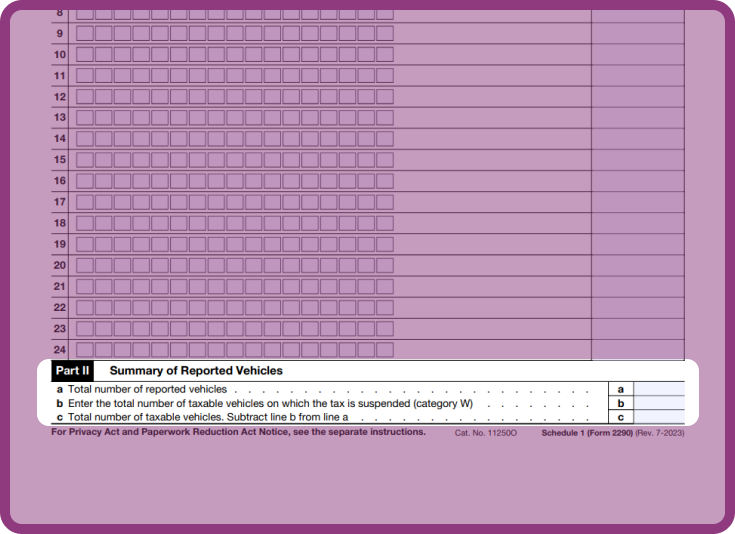

In Part I, provide the following details for the vehicles you are reporting:

Ensure you accurately enter the VIN and weight category for each vehicle you are reporting in Part I of Schedule 1.

In Part II, provide a summary of the vehicles reported on Form 2290, including taxable and suspended vehicles, if applicable. Here’s what you need to include

If you choose to pay your HVUT taxes by check or money order, use the Form 2290-V payment voucher and Form 2290 when sending it to the IRS.

Form 2290-V requires the following information to be filled out:

When mailing your payment, include Form 2290, the payment voucher Form 2290-V, and the payment itself

Mail it to the following address:

Internal Revenue Service

P.O. Box 932500

Louisville, KY 40293-2500

Ensure you accurately complete Form 2290-V and include it with your payment when submitting it to the IRS.

Form 2290 instructions are guidelines provided by the IRS to help truck owners understand how to properly fill out and submit their HVUT (Heavy Vehicle Use Tax) returns. It’s crucial to follow these instructions meticulously to avoid errors and ensure compliance with IRS regulations.

If you have realized that you may have reported an incorrect VIN after submitting your returns to the IRS or if the IRS cites incorrect VINs to reject your returns, then you must file a Form 2290 VIN Correction. IRS Form 2290 VIN Corrections help you report the vehicle identification numbers correctly for previously reported vehicles.

Absolutely! EZ2290 provides detailed explanations alongside the form fields, making it easy for first-time filers to comprehend Form 2290 instructions. Our intuitive interface streamlines the entire filing process, saving you time and effort.

Yes, the Form 2290 instructions outline the deadlines for filing your HVUT return. The deadline for truck owners is August 31st each year.

Yes. All you have to do is register with us and create your account.

Our EZ2290, the #1 Platform for 2290 online filing, includes 4 different options for submitting 2290 payments to the IRS for your HVUT:

If you encounter any doubts or need assistance while filing Form 2290, EZ2290 provides dedicated customer support to address your concerns promptly. Our team is knowledgeable about Form 2290 instructions and can guide you through any challenges you may face during the filing process.